The volatility of the cryptocurrency market provides many opportunities for earning. However, strong price fluctuations also carry some risks for traders. Such a phenomenon as slippage can provoke significant losses during trading.

We tell you why slippage occurs and how you can protect yourself from the negative consequences of the phenomenon.

What is slippage?

Slippage is a term that means the difference between the expected and actual price of order execution.

This phenomenon occurs due to high volatility or insufficient liquidity. A trader can make money on slippage, but more often it leads to the fact that the order is executed at an unfavorable price for him.

Not only cryptocurrency traders can suffer from slippage, this phenomenon is characteristic of all markets. However, it is most often recorded in low-liquid trading pairs, as well as on small platforms or decentralized exchanges (DEX).

Why does slippage occur?

Slippage occurs for the following reasons:

- high volatility;

- insufficient liquidity;

- network overload;

- volume orders;

- technical problems.

Because digital asset quotes can change rapidly within a short period of time, the execution price of an order in high volatility may differ significantly from the planned transaction.

Slippages can also provoke a lack of liquidity or the creation of a large order. In this case, only a certain part of the transaction can be carried out on favorable terms for the user.

For example, in January 2024, an investor lost $5.7 million when buying the meme token Dogwifhat (WIF). The user initiated three transactions that cost him $8.8 million. However, due to the placement of a large order, WIF quotes jumped from $0.15 to $3. Due to the slippage, the unknown trader lost 60% of the investment amount.

In addition, slippages can be caused by technical problems on the platform where the order is placed. For example, a delay in data exchange.

The consequences of slippage are most often faced by users of decentralized platforms. Since DEXs operate on smart contracts and have no central governing body, the trading process depends on liquidity pools. This approach increases the risk of slippage.

Types of sliding

Slippage is relatively common in a volatile market. There are several types of this phenomenon:

- positive – the order is executed on more favorable terms than the investor originally planned. For example, buying cryptocurrencies at a price lower than expected, which brings a potential profit to the user;

- negative – the transaction takes place at unfavorable prices for the investor. Sometimes the user can suffer significant damage, so the risk of slipping should always be calculated in advance.

Slip assessment methods

During trading, the trader must take into account the risk of slippage and be able to assess it in order to correctly calculate the potential profit during the placement and execution of the order.

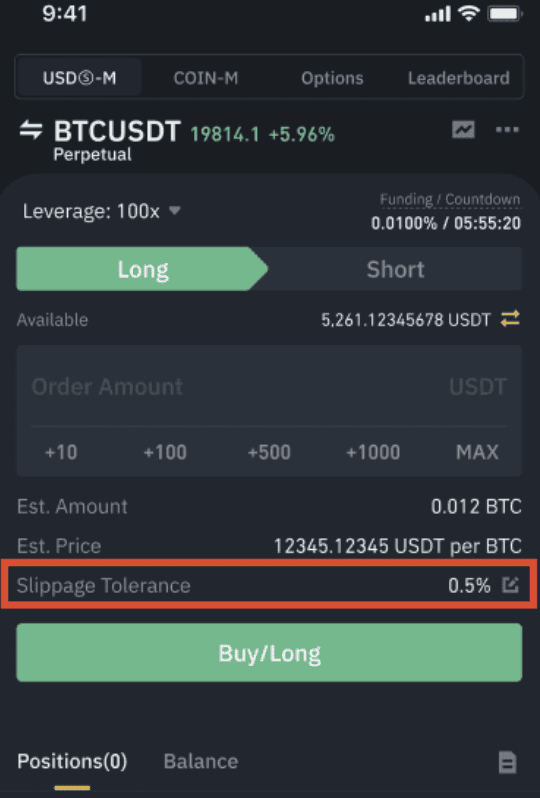

To begin with, the investor determines the acceptable level of slippage. This is the maximum price difference, expressed as a percentage, that suits the trader during the transaction. Such a function is available on many large exchanges and is usually referred to as slippage tolerance. Such tools guarantee that transactions will not take place at unprofitable prices for the trader.

For example, a user plans to buy Bitcoin at a price of $59,000 with a slippage limit of 0.5%. We calculate according to the formula: 59,000 x 0.005 = 295.

So, a slip-up could cost the investor $295.

During periods of high volatility, a higher allowable slippage value may be required to execute orders.

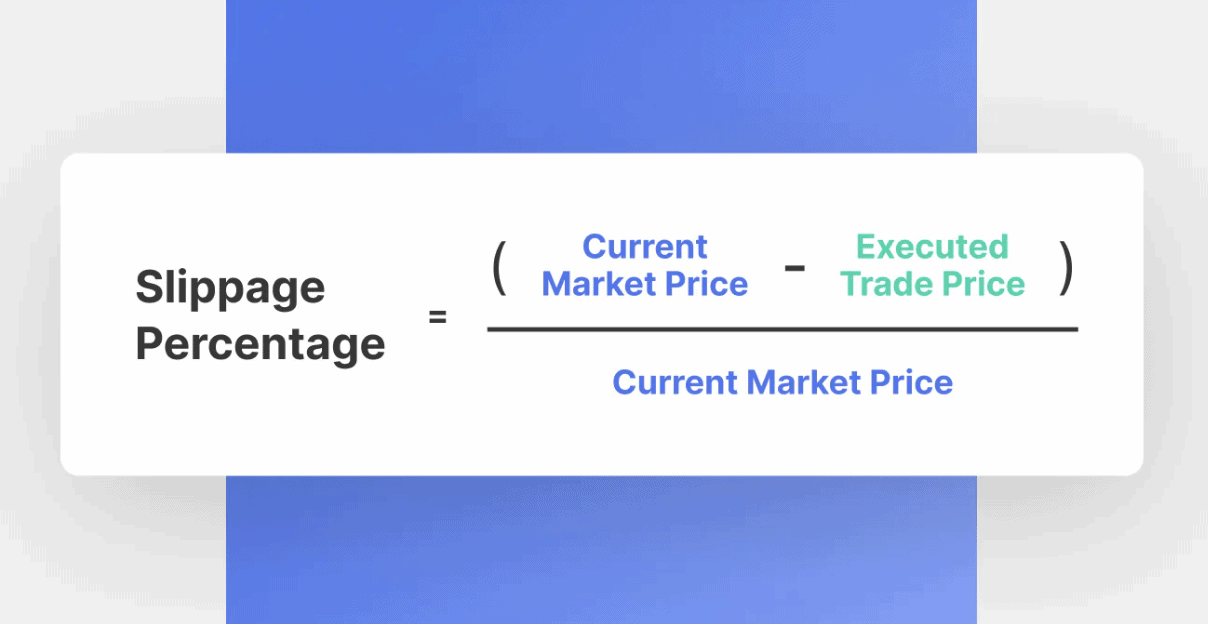

You can also use a simple formula to calculate the slip percentage. To do this, it is necessary to subtract the execution price of the order from the current market price of the asset and divide the result by the current value.

The impact of slippage on cryptocurrency trading

Slippage can occur at any time during the execution of the transaction and affect the result of the execution of the order. The probability of occurrence of the phenomenon depends on many factors, for example, the choice of platform and trading pair.

Each trading pair has a certain level of liquidity and volatility. These characteristics are not permanent and may change. Generally, popular digital assets such as Bitcoin or Ethereum are considered more stable, so slippage is less likely when trading them.

The situation is similar with stock exchanges. Large centralized platforms have high liquidity and a large number of users, which contributes to less slippage. On such exchanges, orders are executed faster and with smaller deviations from the expected price.

However, on smaller or decentralized exchanges where liquidity is lower, slippage may be higher. Such platforms may have a lower volume of trades, which increases the probability of executing an order at a less favorable price due to the lack of a sufficient number of counter-bids.

By default, slippage on platforms like Uniswap ranges between 0.5% and 1%, but the trader needs to constantly monitor a number of factors to adjust the indicator in time.

Some experienced investors take advantage of this phenomenon to obtain additional profits. They develop and constantly change their strategy according to the market situation.

Also, trading bots are used to minimize the undesirable consequences of slippage. This approach allows not only to protect your funds from unpredictable fluctuations, but also to make money from them.

How to minimize slipping?

Although slippage is common, there are several methods to minimize this risk during surgery.

One of the basic rules is to choose platforms with a good reputation and developed infrastructure. Such exchanges, as a rule, can guarantee the liquidity of assets, which positively affects the speed and accuracy of transactions.

Before starting a trade, the investor needs to study the current market situation and evaluate the mood of other users. During periods of high volatility, the risk of slippage increases significantly.

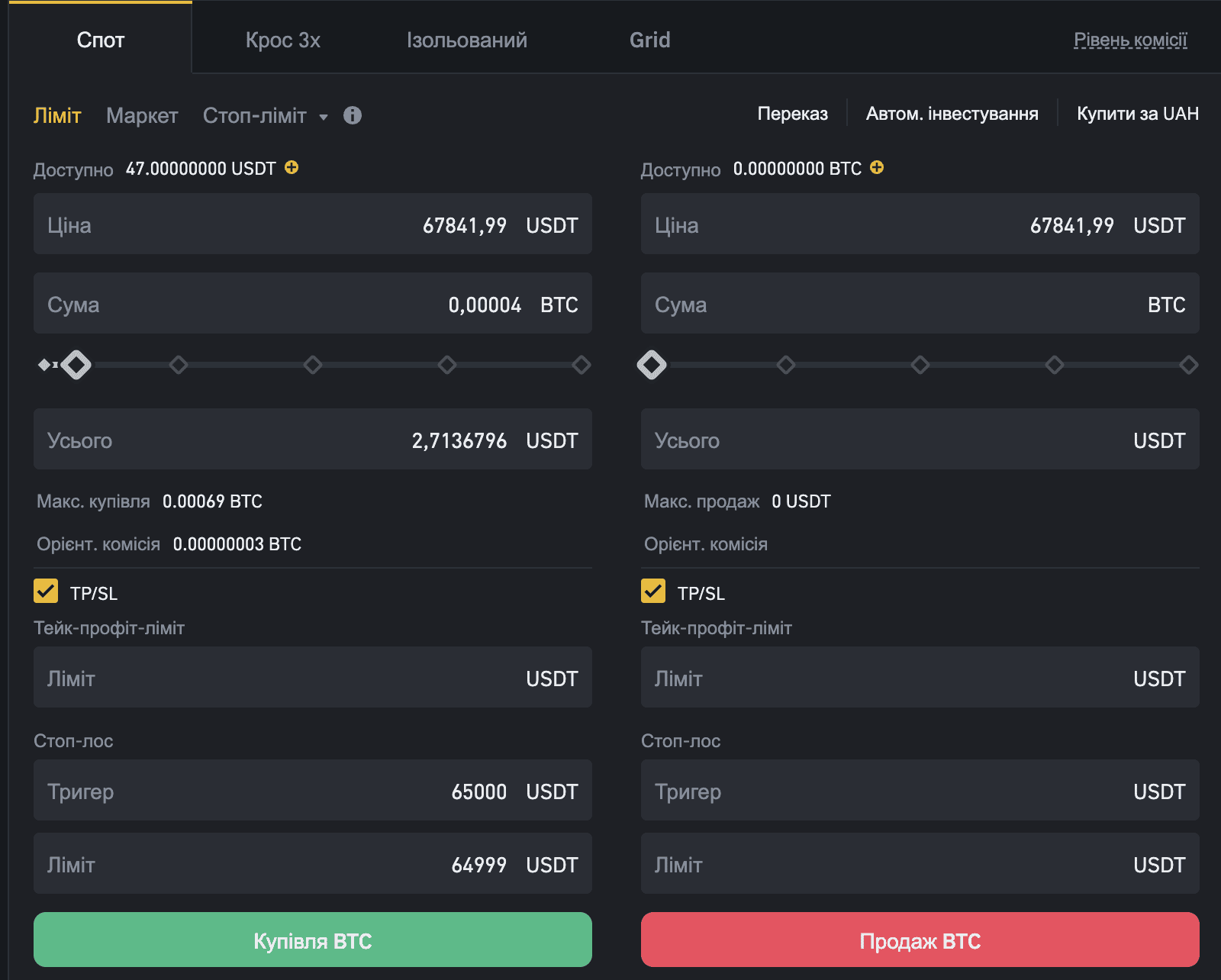

Placing limit orders also helps to avoid undesirable phenomena . In this way, the user designates a specific price for buying or selling digital assets. Limit orders guarantee execution of the transaction at the specified price and minimize losses. However, with sharp fluctuations in the market, such orders can lead to the loss of profitable opportunities.

Another method of minimizing slippage is to set a stop-loss level . The user sets the price of the asset below the current value, so that in the event of a drop in quotations, the position is automatically closed, thus securing funds.

In addition, an investor can use trading bots to protect his portfolio from unwanted costs such as slippage. These are special programs that automatically execute deals when certain specified conditions are met.

Using the listed methods, the trader has better control over the trading process. However, even the implementation of all slip protection mechanisms does not guarantee a 100% result.

Conclusions

Slippages are common when trading cryptocurrencies. This term refers to the difference between the expected price of the contract and the actual execution of the order. This difference is not always for the worse for the investor, but only experienced traders can use slippage to multiply profits.

In order to protect your funds from an undesirable phenomenon, it is recommended to conduct a market analysis, calculate the acceptable slippage value for yourself, and also set such protective mechanisms as limit orders.

Understanding the principle of slippage will help improve risk management during trading.