The intentions of a particular project to launch its own token and distribute it to an active audience are often known in advance, but most users do not take any action to participate in it. As a rule, activity begins after another big hand and quickly leads to disappointment due to the lack of immediate results. Such a sporadic approach leads to losses more often than to earnings.

In this article, we will analyze what airdrops are, what are the features of this token distribution model, and how to turn participation in them into a full-fledged form of earning.

What is a token airdrop?

In the era of the early cryptocurrency market, teams usually used ICOs (Initial Coin Offerings) to raise funding. The investments collected in this way were supposed to be used for the further development of the project, but in practice the funds were often appropriated by the team, and the investors were left with nothing.

Due to the discredit of this format, over time, developers began to use a new model of entering the market – the distribution of tokens between active users and community members. Such campaigns are called airdrops, because the team “drops” assets on users’ wallets.

During the “crypto-winter” period of 2018-2019, airdrops turned out to be a more effective tool for attracting an active audience and entering the market than token sales.

Depending on who and under what conditions the tokens are provided, several types of handouts are distinguished, such as hold-drop , lock-drop, and others. However, the most popular are the so-called retrodrops — distributions that take place after the launch of the product and are aimed at rewarding active users.

The terms of retrodrops are usually unknown in advance, which helps to identify an interested audience that is ready to use the product without additional incentives. Similar campaigns were conducted by many well-known projects, including Arbitrum, Aptos, 1inch and Uniswap.

What are the benefits of airdrops?

For developers, airdrop is a go-to-market strategy that allows you to attract a loyal audience. At the same time, the model shows itself to be more effective compared to token sales, as it takes into account the following features of the industry:

- a large number of speculators who buy tokens only for the sake of “easy” profit. Because of this, a direct sale is highly likely to wash out liquidity and collapse quotes after launch;

- the ability to monitor the online activity of addresses to determine how much the user is interested in cryptocurrency, which projects he has previously interacted with, etc. This allows you to select the most relevant target audience.

Due to this, airdrops help to avoid the transfer of tokens to “weak hands”, as well as to increase the effectiveness of the marketing campaign. In addition, this tool solves the problem of “cold start” and reduces the cost of acquiring an initial audience.

Token distributions are also used when entering a competitive market through the so-called ” vampire attack ” – the distribution of assets among the opponent’s community in order to lure users.

In 2020, the decentralized exchange SushiSwap launched a vampiric attack on its direct competitor, Uniswap. The service paid Uniswap liquidity providers an additional reward in SUSHI tokens for blocking their LP assets.

For users, the value of airdrops lies in the following aspects:

- the opportunity to receive a conditionally free asset. Although drophunters have to cover transaction fees and other operational costs, in the case of a successful distribution, they receive the token at a much lower price than most other market participants;

- integration into the community. Often tokens give holders certain privileges when using the product or the right to vote, making them part of the community;

- social and reputational capital. For some users, the financial result is of secondary importance, but thanks to the airdrop, they understand that their contribution has not gone unnoticed.

In addition, thanks to interaction with projects within the framework of such campaigns, newcomers get the opportunity to learn the basic principles of blockchain work and better understand how certain tools are arranged.

How much can you earn from airdrops?

The scale and profitability of a particular distribution depends on how much money the project managed to attract and the features of its token economics. If we talk about the industry in general, projects give out literally billions of US dollars as part of airdrops. Thus, in 2023, the total amount of distributed assets exceeded $4 billion, and in 2024, projects reached this indicator in six months.

If we talk about the size of a specific handout, there are also ten-digit numbers here. For example, the Uniswap team distributed $6.43 billion worth of UNI tokens to users, and Apecoin developers sent a total of $4.5 billion in digital assets to the addresses of NFT owners from the Bored Ape Yacht Club (BAYC) collection.

In some cases, you can get a reward even for simple actions that do not require operational costs and are available to most users. Yes:

- Aptos distributed 150 APT tokens per NFT mint in the testnet;

- the Wormhole team sent 8000 W to users who got the Discord role of the Monad project;

- the Uniswap early adopter reward was at least 400 UNI for several completed transactions.

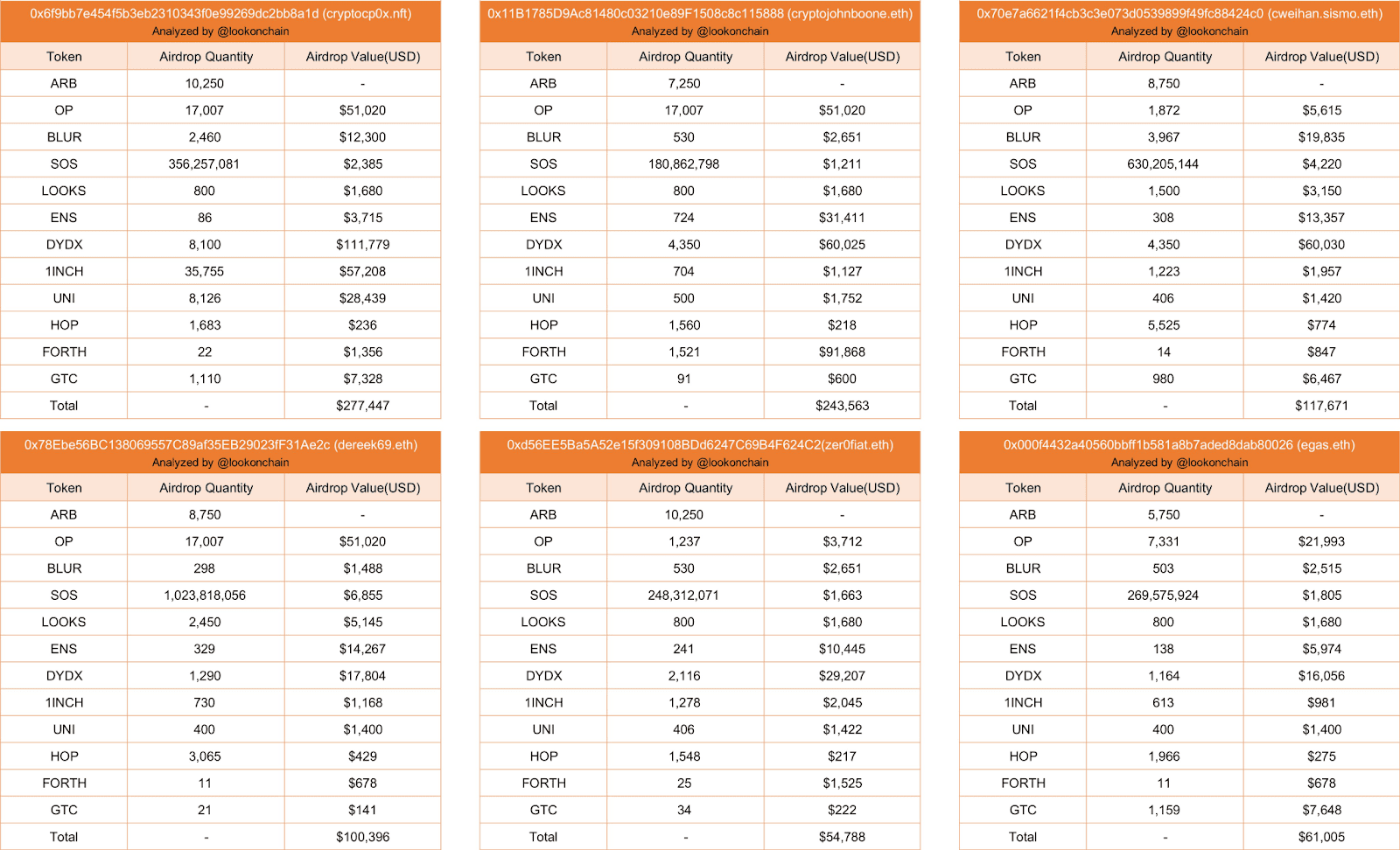

Active community members who have capital at their disposal can receive a much higher reward for their contribution. According to Lookonchain , the amount of distributions received by some addresses is estimated at hundreds of thousands of dollars.

Of course, the potential profit often depends on the amount of capital involved in a particular project. However, even with small investments, you can get tangible income by using multi-accounting and effective strategies for interacting with platforms.

Top 5 airdrops for 2024-2025

At the end of 2023, as well as in the first half of 2024, there were relatively large distributions from such popular projects as Starknet, zkSync and Layer Zero. However, the airdrop trend continues, so in the second half of 2024 and early 2025, we should expect a few more distributions from major protocols and platforms. First of all, it is worth noting:

Zora

Zora is an NFT marketplace with its own Layer 2 (L2) network for Ethereum, launched in June 2023. The blockchain, like the platform itself, is aimed at creating a higher-quality interaction experience with non-fungible tokens compared to existing solutions.

The team is likely to announce the token distribution near the end of 2024 or early 2025. With an investment of $60 million at a market valuation of $600 million, the project can handsomely reward early adopters and an active audience. A detailed guide on interacting with Zora can be found on the Encrypted website .

Scroll

Scroll is a proof-of-concept, zero-disclosure second-level blockchain for Ethereum that launched in October 2023.

Since the beginning of 2024, the developers have conducted several campaigns aimed at attracting users and capital. Probably, based on the results of these events, the future distribution of project tokens will be conducted.

Scroll has raised $80 million in funding at a valuation of $1.8 billion, which could indicate a potentially high reward for active users. Detailed instructions for interacting with the protocol are available on the Encrypted website .

Fuel

One of the most famous representatives of modular blockchains is the Fuel project. For a long time, the network was at the testnet stage, but in July 2024, the team announced a points program to attract activity “in connection with the approach to the launch of the main network.”

Fuel managed to attract $81.5 million in investment at a valuation of $1 billion, which raises the possibility of a big deal. You can also use the Encrypted guide to participate in the Fuel campaign .

Babylon

Babylon is a staking protocol that will allow Bitcoin holders to profit from asset staking. Since the beginning of 2024, Babylon has been in the testnet stage, but in August it launched the first phase of the main network.

The project roadmap includes the launch of the token, therefore, despite the lack of official statements from the team, there is a high probability of its distribution via airdrop.

It is also worth noting that Babylon managed to attract $96 million in funding , and Binance Labs is among the investors of the protocol.

Linea

Linea is another Tier 2 solution for Ethereum from the developers of ConsenSys, who gained wide popularity after the launch of the non-custodial cryptocurrency wallet MetaMask.

ConsenSys has not announced separate funding rounds for Linea, but during its existence the company has managed to attract a total of $725 million in investments at a valuation of $7 billion.

At the time of writing, users can interact with the network as part of the Linea Voyage: The Surge campaign. Detailed instructions are available on the Encrypted website .

It is worth noting that although these are the most anticipated and capitalized projects with potential distribution of tokens, they are far from the only ones on the market. So, for example, the Solayer restaking protocol is gaining popularity in the Solana ecosystem with a $12 million investment.

Farcaster, a blockchain platform for creating decentralized social networks, whose development was financed by $180 million a16z, Paradigm and dozens of other well-known funds, may be no less potentially significant . instructions for interacting with most airdrop-oriented projects, as well as additional information about token distributions, can be found on the Incrypted website in the Airdrops section .

What do you need to do to get an airdrop?

The terms of participation in token distribution differ from project to project and often depend on the stage of product development. Therefore, the actions of drophunters can be divided into the following categories:

- interaction with the product. Token exchange, bridging, liquidity provision and other operations. These actions require an understanding of the principles of operation of blockchain services, as well as the payment of commissions;

- quests As a rule, projects conduct quest campaigns on services such as Galxe , Zealy or Layer3 to attract users and stimulate specific activity. Often, the performance of such tasks is taken into account when distributing tokens or is rewarded directly;

- participation in the testnet . Before launching on the main network, most products are tested in the testnet. At this stage, users can interact with the project without risking real assets, and feedback is a valuable contribution to the development of the project;

- ambassador programs. Ambassadors are active community members who help create and distribute project-related content, engage audiences, and increase brand awareness. Often this activity makes it possible to apply for participation in the giveaway.

Another type of rewarded activity is starting and maintaining nodes. The drop size for node owners is usually higher than for regular users, but this activity requires investments and some technical skills.

Safety rules when participating in giveaways

Token giveaways target a wide audience and attract a large number of newcomers to the industry, which scammers and unscrupulous developers take advantage of. The most common dangers for participants of such events are:

- phishing First of all, these are fake sites, pages in social networks or mailing lists, through which malicious links are distributed to steal assets or personal data;

- fraudulent projects . During the active phase of the crypto market, hundreds of teams announce plans to launch a token, which does not give newcomers enough time for detailed research. Some of these services are created in advance only to get hold of users’ funds in one way or another, for example, through rug-pull or insider operations;

- broken Often, airdrop organizers are at the stage of testing a product that has not yet passed a security audit. Interaction with such sites is associated with increased risks of hacking and embezzlement.

To protect your wallet and preserve your assets while participating in the giveaway, it is important to follow a few safety rules:

- verify announcements. Most often, phishing links are distributed through personal messages or announcements on social networks using clone profiles or hacked official accounts. If you come across a suspicious ad, check the information in several sources, and if necessary, contact the team representatives;

- share capital. To participate in the airdrop, you often need a “warmed up” wallet with a history of activity, but it is better if it is a special address with an allocated amount, and not the main wallet. This will help protect most of your savings in the event of a break-in or theft;

- master risk management. Little-known projects should be perceived as high-risk — even an honest team can suffer from hackers and lose user funds. Consider this when determining the amount of working capital for new protocols and platforms.

- pay attention to safety. Follow security experts like PeckShield for updates on hacks and developer scams. Also, don’t forget about useful wallet protection services like Revoke .

And most importantly, always do your own research. The more carefully you study the target project, the less chance fraudsters have to take your money. This rule works in any segment of the cryptocurrency market.