Top 4 types of manipulation in the cryptocurrency market: who and how manages the market?

The cryptocurrency industry continues to attract traders and investors who want to earn big and fast income from the volatility of digital assets and speculation.

However, high volatility combined with relatively low capitalization of individual currencies and the market as a whole creates opportunities for price manipulation by large players. As a result of these actions, inexperienced users often make irrational decisions that lead to the loss of capital and the enrichment of manipulators.

The editors of Incrypted analyzed the main manipulations in the market of digital assets, as well as their consequences for users and methods of resistance.

What is considered manipulation in the cryptocurrency market

Manipulation in the crypto industry is understood as a purposeful action by a market participant with significant resources (manipulator) to artificially change the value of an asset that does not reflect its real value or current demand from users.

Manipulators can use different methods to influence the price, but their ultimate goal remains the same – to profit at the expense of less experienced retail investors and traders. This can be achieved, for example, through a deliberate collapse of quotations in order to further purchase the asset at a lower cost.

Top 4 manipulations on the crypto market

There are a huge number of strategies for targeting the value of an asset, and all of them are used to one degree or another in the relatively loosely regulated crypto market. However, below we list four of the most common methods that can be used either alone or in combination with other tools.

Fictitious trade

Fictitious trading is a financial term that refers to the organized execution of transactions by one person or a group of persons to create the appearance of high activity in one or another market.

As a rule, the manipulator buys an asset and then sells it to his bogus account or to counterparties connected to it, repeating these actions a huge number of times. This leads to an incorrect assessment of the demand for the cryptocurrency by other traders, which prompts the user to make a purchase, even at an inflated cost.

This method is especially often used in the memcoin market, where the creators of new tokens artificially increase the volume of trades and regulate the ratio of buying and selling to attract an audience. For many developers, sham agreements are a cheap and quick way to overcome the “cold start” problem, but it is often used as a preparatory stage for other manipulations or outright fraud.

Pump and dump

Pump and dump (pump and dump) is the most popular scheme for manipulating the market, which includes four stages:

- The manipulator causes an artificial increase in the value of the crypto-asset (pump).

- Bullish quotes create FOMO and greed among retail traders , prompting them to buy the token even at an inflated price.

- When the necessary price marks are reached, the manipulator sells the previously purchased assets and fixes the profit at the expense of “heated” traders (dump).

- As a result, the price collapses, returning to the values it was at before the pump or even falling below.

An increase in demand is achieved through the publication of positive news about cryptocurrency or through active promotion in social networks. It is also possible to initially buy back part of the offer to slightly increase its value in order to attract the attention of retail users, that is, the already mentioned dummy auctions.

This manipulation is difficult to prove, since it is necessary to trace the relationship between the organized actions of the big players and the price movements of the token. So, in September 2021, the news appeared that the chain of retail stores Walmart entered into a partnership with the Litecoin Foundation, which led to the growth of the LTC coin by 30%, but a subsequent denial sent the quote back to its previous level.

From the outside, the price dynamics looks like a classic pump and dump, but the manipulation takes place only if a participant or group of market participants deliberately spread fake news in order to sell their assets against the background of growth.

Bear raid

A bearish run is the exact opposite of a pump and dump pattern. In this case, manipulators open short positions on cryptocurrency exchanges, and then spread negative news about the token to cause panic and further sell-off of the asset

In fact, the bearish run and pump and dump are based on the same principle of profiting from an organized price change, but the bearish run allows you to profit from falling quotes, not rising. This strategy is often used for projects with problematic reputations that have already been criticized.

Spoofing

Spoofing is the placement of large orders to sell or buy an asset, which the manipulator cancels before their actual execution.

This action occurs to create a false impression of supply and demand in a particular market. The manipulator, in fact, exploits the availability of data on open exchange orders, as well as the low speed of execution of large orders, causing the desired reaction from retail traders.

For example, seeing a large order to buy a token, traders will try to buy the asset faster to get ahead of the deal and then sell their coins at a higher price. Having caused the desired reaction, the manipulator cancels his request and takes reverse actions, that is, sells the token, taking advantage of the increased demand from retail users.

How to recognize manipulation

The ability to recognize manipulation often depends on the complexity of the scheme and the level of its organization. Often, even regulatory authorities, let alone ordinary users, cannot prove deliberate influence on the market, but some tools to protect against malicious actions do exist.

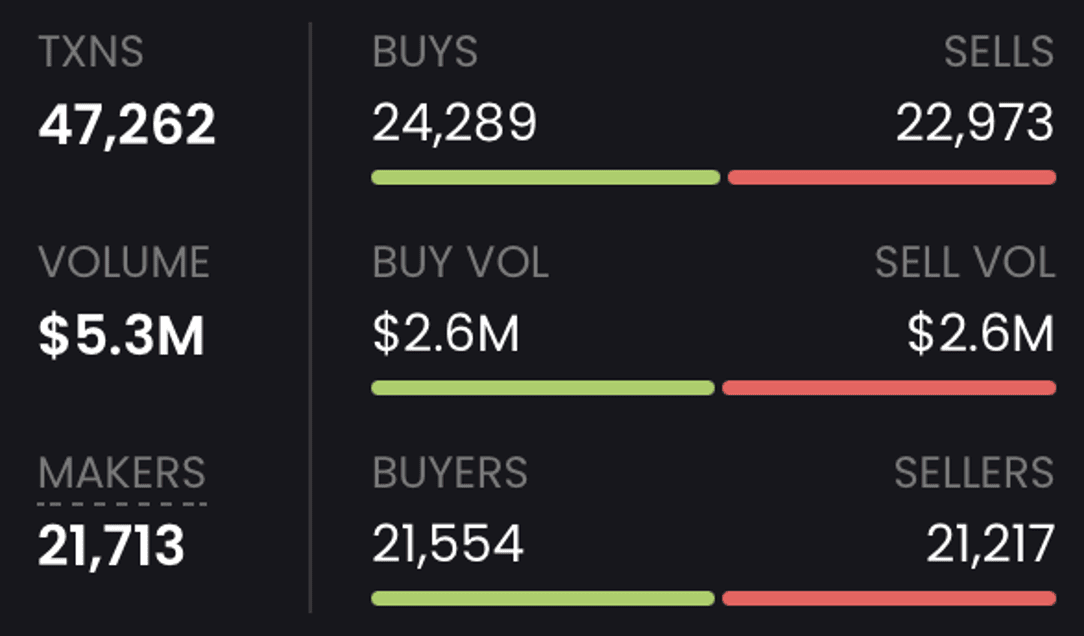

Yes, fictitious trading can be detected using open exchange data or special services such as DEXScreener or TradingView . If the number of buy and sell orders, as well as their amounts, are approximately the same, there is a possibility that the manipulator artificially increases the volume of trades by issuing mirror orders from one or more accounts.

In the case of a pump and dump, as well as a bear run, it is necessary to clearly define which events really affect the demand of traders. If the published news is not significant from the point of view of fundamental and technical analysis, but it is followed by a significant price change, then it is probably caused by a manipulator. In this case, it is worth conducting a deeper study of the transactions to detect organized buying and selling.

Spoofing is more difficult to calculate, since it is impossible to guess in advance whether the user will wait for the application to be completed or cancel in advance. In this case, you can focus on the general market situation — if a big deal is happening against the current trend, then when making a decision, you should take into account the risk of possible manipulation.

How to resist manipulators

Since manipulation leads to changes in the trend in a certain market or, at least, a trading pair and is associated with the use of large capital, it is extremely difficult to resist them. For retail traders, the most rational strategy is to take into account and minimize the risks of targeted influence on the value of assets.

Whenever there are unwarranted or sudden changes in quotes, it’s a good idea to do your own research and make decisions based on objective data, not emotion or outside advice.

Short-term volatility can be artificially induced, so it is first important to determine what will happen to digital currencies in the medium to long term. In addition, when buying new cryptocurrencies, you should always carefully study them with the help of fundamental and technical analysis and only then proceed to action.

It is also important to consider that manipulations are usually aimed at a certain asset, so it is worth diversifying your investments to minimize losses. In general, in order to protect against manipulators, it is important to form an action plan for any development of events, which would include the probability of one or another targeted influence, and stick to it.

Consequences for investors and the market in general

Since the manipulation of the crypto market requires the involvement of significant resources, they are carried out by large players and are primarily aimed at retail investors. It is the latter who are victims and “outgoing liquidity” for manipulators, enabling them to enrich themselves with their own money.

At the same time, any manipulations have a negative impact on the industry in general, slowing down its development, as well as scaring away potential investors who simply do not want to enter into deals in such a risky and unregulated market. In addition, the spread of fraudulent schemes hinders the wider adoption of digital assets, complicating their interaction with traditional trading platforms.

Conclusions

The cryptocurrency market is young and volatile compared to traditional finance, which creates favorable conditions for price manipulation and fraud by big players. The most common ways to influence quotations are spoofing, pump and dump, as well as fictitious deals and a bear run.

As a result of such schemes, retail traders suffer losses, and potential investors often refuse to invest in digital assets. It is likely that some manipulations will be stopped after the appearance of comprehensive and well-thought-out regulation of the crypto market, but for now, users need to protect their capital on their own by conducting thorough research on assets and trading data.