The funding rate or funding rate is the difference between the mark price of a perpetual contract and the price of an index that is equivalent to the value of the underlying asset.

Marking price refers to the estimated true value of the contract — it is also known as the current market value (market-to-market).

The funding rate aligns the derivative quotes with the index, encouraging the contracts to trade near spot prices. On its basis, periodic payments are made to traders in the market of open-ended futures contracts.

Depending on the value of the asset, the financing rate can be:

- positive — the futures price is higher than the value of the underlying asset;

- negative — the futures price, accordingly, costs less than the asset on the spot market.

The indicator is calculated by exchanges several times a day, the system automatically transfers funds from one trader’s account to another. If the funding rate is positive, the commission is charged to traders who are long positions. In the case of a negative rate, the owners of short positions lose money.

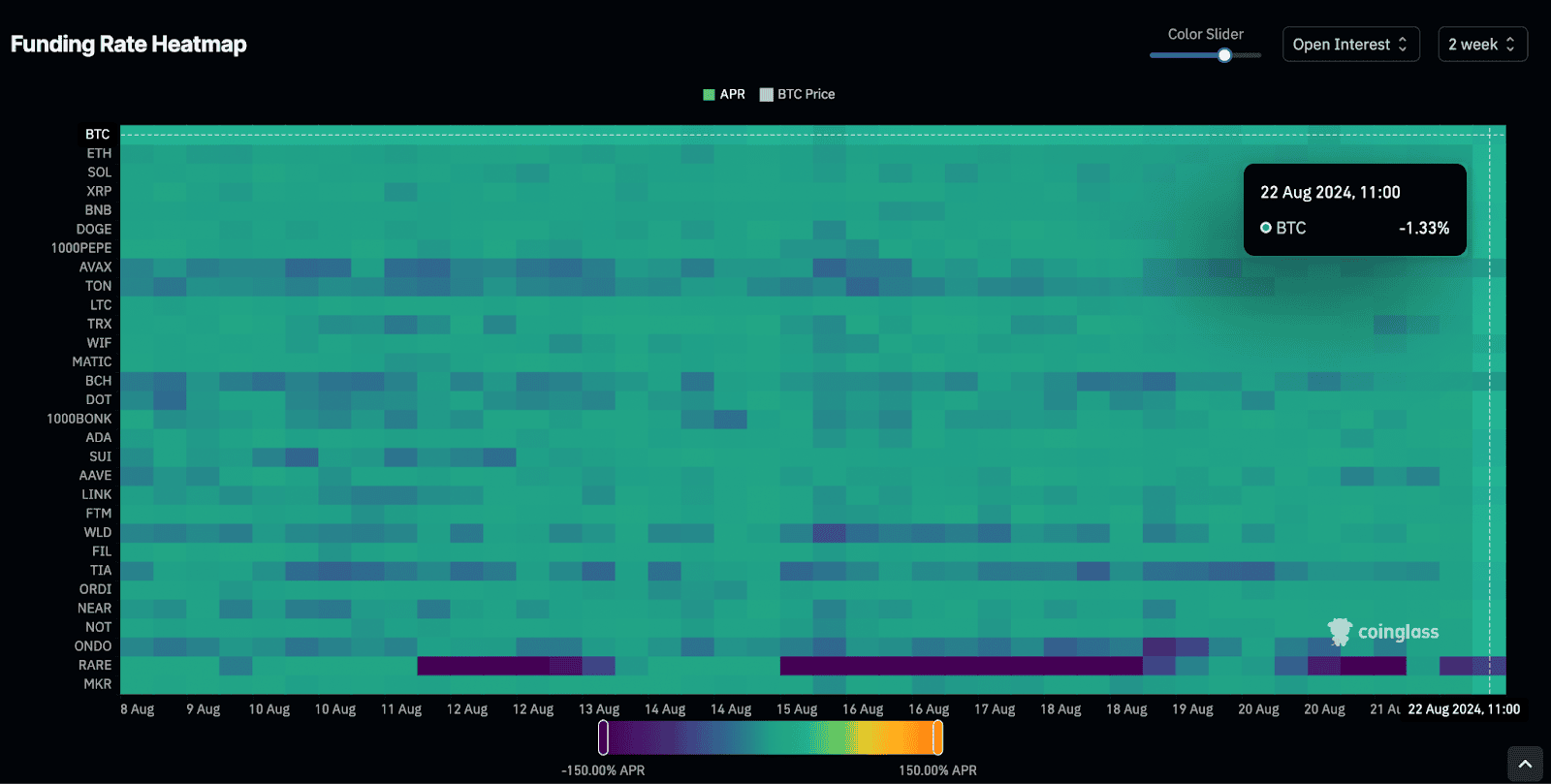

For example, as of August 22, 2024, the average funding rate in the Bitcoin market was estimated at -1.33%, according to data from CoinGlass .

How to calculate the funding rate

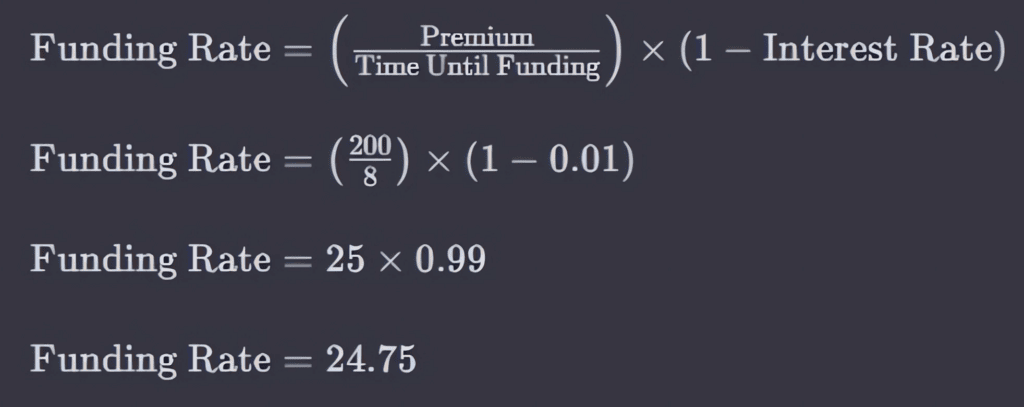

To calculate the funding rate, it is necessary to have information about the interest rate, premium or discount of the futures contract, as well as the time of revision of the coefficient on the stock exchange.

For example, the price of a bitcoin futures contract is valued at $40,000, while the spot market price of digital gold is $39,800. Accordingly, the discount is $200 (the base price of the asset is subtracted from the futures value). At the same time, funding is automatically recalculated every eight hours, and the interest rate is 1%.

Using the formula below, we get: (200/8) x (1 – 0.01) = 24.75.

It is worth noting that on most exchanges the funding rate is calculated every eight hours, but the time may vary depending on the platform. Also, some sites can adjust the coefficient in moments of strong market volatility.

For example, Bybit warns that they can round the indicator, for example, from 0.75 to 1.

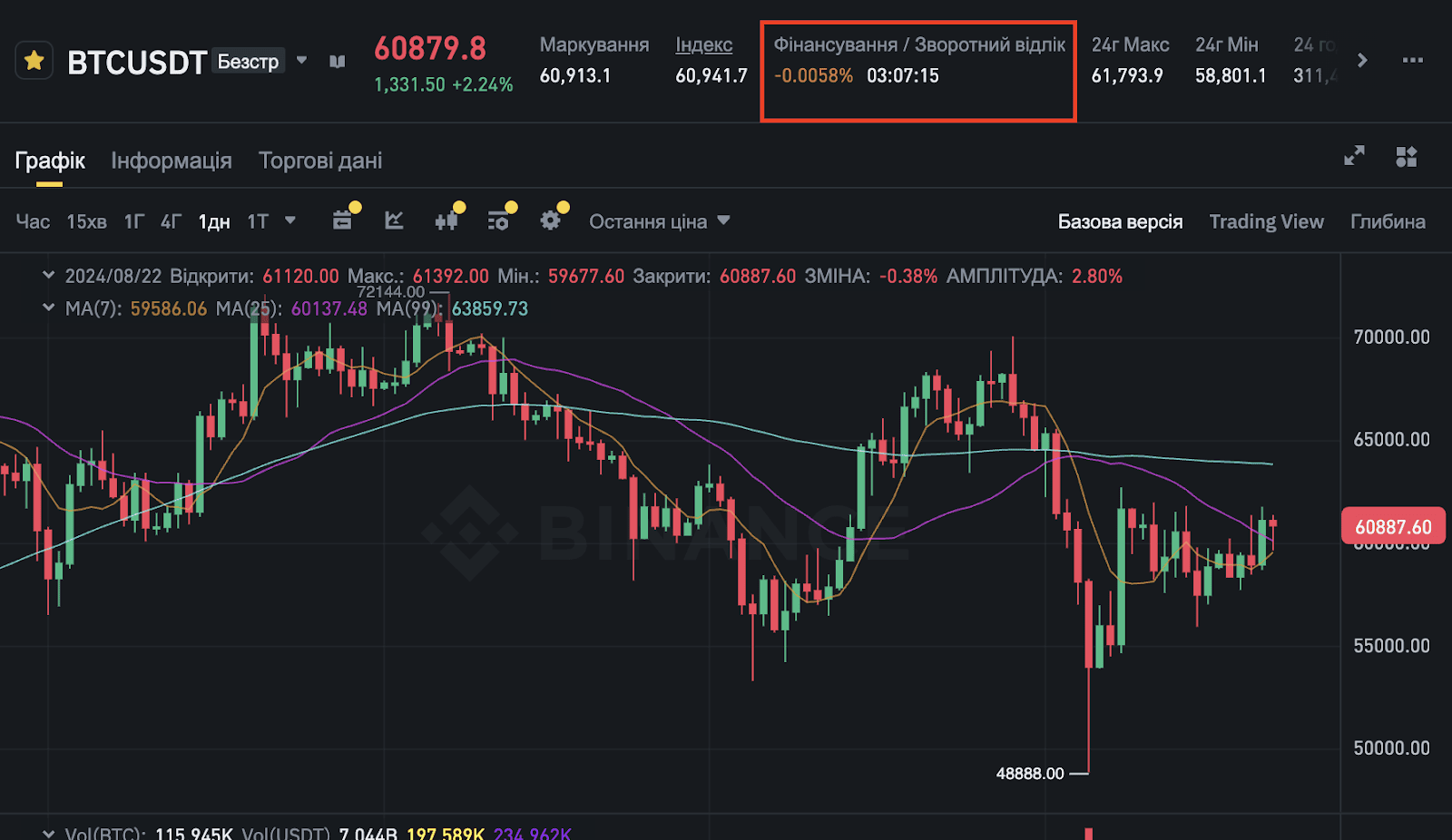

On Binance, the funding rate is calculated at eight-hour intervals, the panel shows the current ratio and a countdown to the next indicator update.

What is the funding rate for?

The financing rate not only ensures price parity on the futures market, but is also an indicator of investors’ mood.

For example, in August 2024, CryptoQuant analysts recorded the lowest value since October 2023 for the Bitcoin funding rate on the Binance crypto exchange. According to experts, the market was dominated by short positions, which could indicate a short-term bearish trend.

The coefficient is a kind of guarantee that the price of the open-ended futures contract will remain as close as possible to the spot price of the underlying asset.

Fluctuations in the funding rate encourage traders to bid. Such a mechanism ensures a constant flow of liquidity to the market for efficient functioning.

The rate also helps maintain a balance of power between traders by preventing excessive dominance of long or short positions, thus preventing imbalances in the market.

To conduct successful transactions, the trader needs to constantly monitor the funding rate, because sometimes it is simply not profitable for the user to keep his position open for a long time.

A timely and correct reaction will help:

- better risk management and cost planning;

- assess the current market mood;

- predict the movement of quotations;

- choose the optimal time for entry and exit from the position.

However, one indicator is not enough to predict market trends, as this approach is not considered representative. In order to make the most complete picture of the events taking place in the market and take into account all possible risks and opportunities, it is necessary to conduct technical and fundamental analysis of the market.

Conclusions

The funding rate supports the stable and efficient operation of the market of open-ended futures contracts. This mechanism helps to keep the prices of derivatives as close as possible to the value of the underlying assets. It also encourages traders to open new positions by attracting liquidity and reflects the current market situation.

However, the funding rate should not be considered as a separate tool. This approach can lead the user to serious mistakes and loss of funds. The ratio is one of many technical indicators that you need to pay attention to when planning an investment strategy.