One of the key ways to manage financial risk is to diversify funds between several assets. Such a portfolio can be managed both independently and entrusted to funds that offer to distribute finances in various areas of the economy with the help of only one investment.

One of these is an index fund, the essence and principle of which the Incrypted team has discussed in this article.

What is an index fund?

An index fund is a type of fund that tracks the performance and performance of a specific market index, such as the S&P 500, Russell 2000, Wilshire 5000, etc., which is a measure of the performance of a specific sector of the economy. Such a fund can invest in all the securities included in the market index, or only in some part of them.

Usually, such funds follow a passive investment style. This means that the fund seeks to maximize returns over the long term without buying and selling assets very often.

Here are some of the market indices tracked by the following funds:

- The Dow Jones Industrial Average (DJIA) is one of the oldest and most famous indexes, which includes 30 significant US industrial companies;

- S&P 500 is a well-known index that includes the 500 largest US companies;

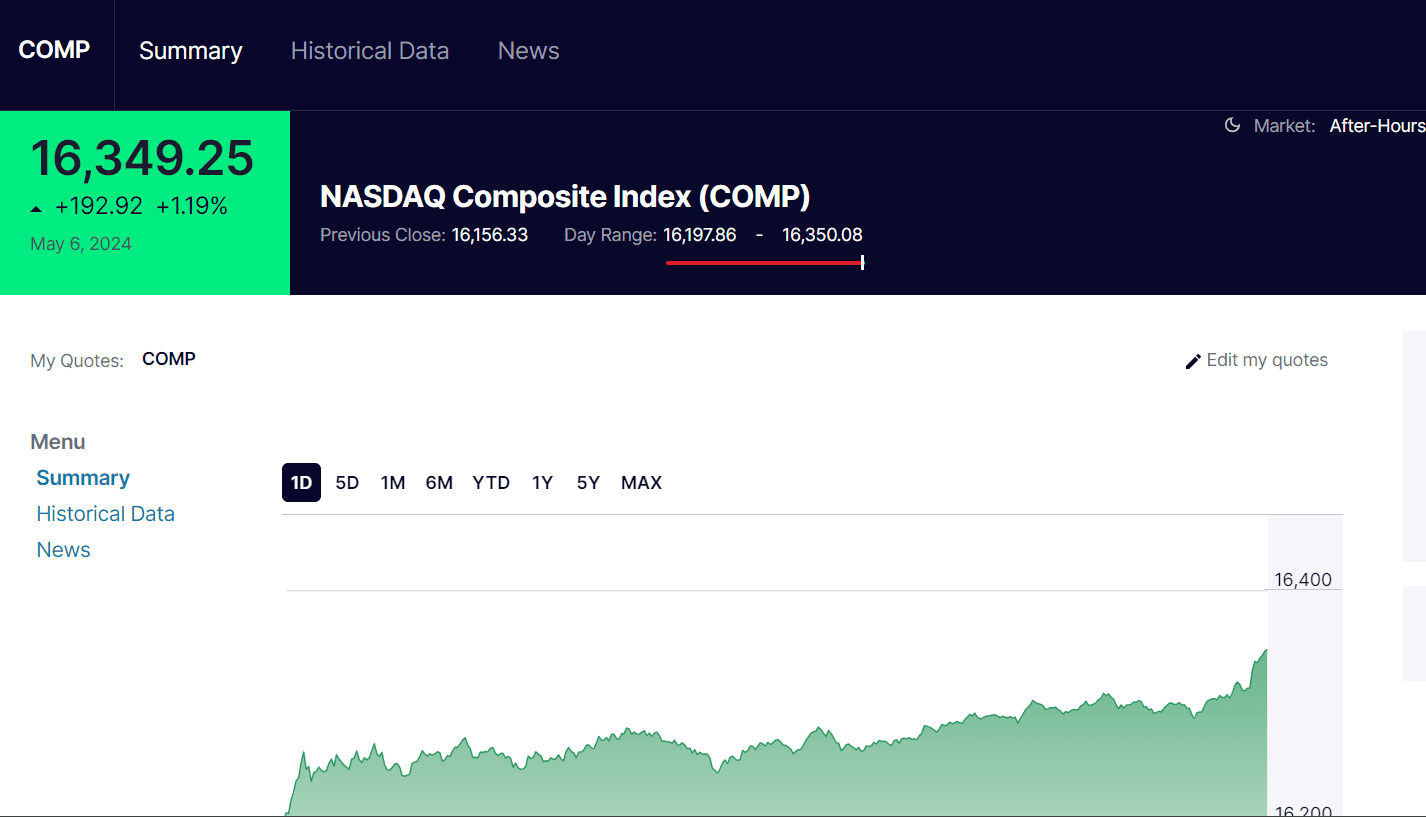

- NASDAQ Composite is an index consisting mainly of technology companies, often used to evaluate the high-tech market;

- FTSE 100 (Financial Times Stock Exchange 100 Index) is an index that includes the 100 largest companies registered on the London Stock Exchange;

- The Nikkei 225 consists of the 225 largest companies in Japan listed on the Tokyo Stock Exchange.

How does an index fund work?

The functioning of index funds is organized in such a way that they are both as transparent as possible and efficient. Their managers buy assets that exactly correspond to the index that is tracked.

For example, an S&P 500 index fund will invest in the 500 companies included in that index, while weighting each one according to its market capitalization.

If the composition of the index changes, the fund will make similar changes to stay in sync. Although you won’t be able to invest directly in a market index, you can buy shares of a fund that is an exact reflection of it. A fund pools investors’ money, and the fund manager uses those funds to try to replicate a benchmark index.

In this way, the investor gets access to all the underlying assets of the fund, which makes it the simplest method of investment allocation.

Advantages and disadvantages of index funds

Index funds offer a number of advantages:

- simplicity. Index funds offer a simple investment option that is especially attractive to beginners. They simplify the investment process, eliminating the need for constant monitoring or making complex decisions about individual stocks;

- diversification Provide a wide distribution of investments in shares of various companies with just one purchase of shares of an index fund;

- low financial risk. Investments in such funds, as a rule, have little risk, although they are not without it and may be subject to market fluctuations. However, the overall volatility of index funds is usually lower;

- stability. Such funds aim to replicate the performance of their underlying index without trying to beat it. Such a strategy ensures stability in the long term.

Disadvantages of index funds include:

- tracking error. Although index funds try to track their underlying index closely, there are small differences that can affect the fund’s performance;

- low profitability. Index funds tend to provide steady but modest returns, especially those that include thousands of different assets. Although high diversification can increase investment safety, it can also reduce the chances of generating significant annual returns;

- low flexibility. Provide more stable returns, but are less suitable for short- and medium-term investors who may need to react quickly to changes in the market.

The impact of index funds on the financial market

Index funds have affected market dynamics in several important ways:

- increasing market efficiency. Index funds allocate capital in proportion to the market capitalization of companies, which helps to better determine prices and more accurately reflects the true value of shares;

- lower trading costs. The growth of index funds has led to lower fees for investors. Because index funds are primarily passively managed, they incur fewer transaction costs than actively managed funds;

- impact on stock prices. By investing in a broad segment of the market or individual sectors, index funds can significantly influence share prices. When a stock is added to an index, such as the S&P 500, the index funds that track that index buy that stock, potentially driving its price up. Conversely, if a stock is removed from the index, it may come under pressure from sellers;

- reducing market volatility. Index funds can potentially affect this because of their long-term, passive investment approach. Rather than trading frequently based on market news or events, index funds buy and hold securities;

- concentration of market power. A side effect of the massive growth of assets under management of index funds is the concentration of ownership. Large index funds own significant shares of many large companies. Such concentration may raise concerns about the impact these structures may have on the corporate governance of an organization.

Cryptocurrency index funds and their impact on the market

Cryptocurrency index funds work on a principle similar to traditional ones. They track the performance of a predetermined pool of cryptocurrencies, which can be based on market capitalization, project type (e.g. DeFi, oracles, etc.) or other criteria.

Like traditional index funds, they are passively managed and also buy and hold digital assets according to the composition of the index they mimic.

There are different types of cryptocurrency index funds:

- funds that prefer cryptocurrencies with a high market capitalization and build their portfolio on this basis;

- in contrast, there are funds that evenly distribute the weight among all coins, regardless of their market size;

- thematic index funds focus on specific cryptocurrency niches such as DeFi or NFT. For example, the Bitwise DeFi Crypto Index Fund targets the 20 most popular DeFi tokens and adjusts its holdings monthly;

- some platforms allow investors to create personalized funds based on their own selection criteria. This method offers the most flexibility, allowing users to fine-tune the index to personal preferences.

Instead of randomly buying cryptoassets, these funds track selected ones and channel investors’ capital into them. The client makes the investment, while the index fund management continues to allocate capital among the various projects in its index.

The introduction of crypto-index funds has changed the way investors view cryptocurrency. At first, many of them were afraid of losing their assets due to the volatility of the cryptocurrency market, but with the advent of such funds, the risk of financial loss has become less, which automatically attracts more investment in Web3.

Conclusions

Index funds have become an important part of the financial world, offering an easy way to invest. These funds allow you to replicate the performance of major market indices, providing diversification and reducing potential portfolio risks through a passive investment approach.

Given their capacity for simplicity and efficiency, index funds remain an attractive choice for many who seek reliability and stability in their investments.