Today, the Incrypted team will talk about Wirex, one of the leading payment platforms for cryptocurrencies and more.

What is Wirex and how does it work?

Wirex is a UK-based fintech company licensed by the UK’s Financial Conduct Authority (FCA). Its main product is an online banking platform that enables customers to transfer and exchange crypto-assets and fiat currencies.

The company was founded in 2014. Its offices are located in London, Atlanta, Dallas, Singapore, and the R&D center is located in Ukraine. At the time of writing, the platform is available in 130 countries.

Main functions of Wirex

Wirex provides a payment platform that allows you to manage and use digital and traditional currency in one place. The service allows users to store, send, receive, buy, sell and spend more than 37 cryptoassets.

Wirex provides the following features:

- a multi-currency wallet allows you to store, send and receive both digital and fiat assets. However, Wirex Wallet is separate from the main application, so users of the wallet cannot use other services of the company;

- the X-Account function allows you to earn up to 20% interest in selected currencies and instantly withdraw funds without commission or spend them using a Wirex multi-currency card;

- Wirex Travelcard is a multi-currency travel card. More than 12 digital currencies and paper currencies are supported;

- the company also gives its customers the opportunity to issue a Wirex card , which can be used to spend assets on the account, including stablecoins;

Wirex Pay is a decentralized payment network that combines traditional and decentralized finance (DeFi). It integrates blockchain technologies with traditional payment systems such as SEPA, Visa and Mastercard.

Sign up and get started with Wirex

In order to start using the service, you need to take several steps:

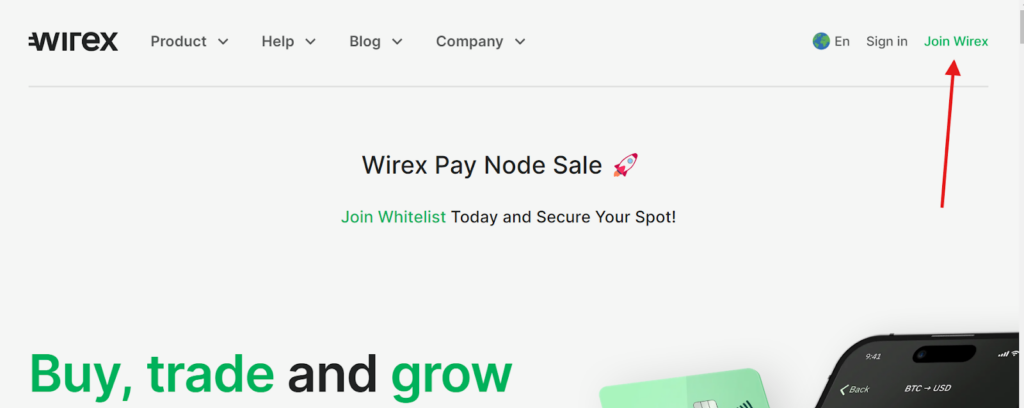

- To sign up, go to the Wirex home page and click Join Wirex.

- Enter your country of residence, email address and password as prompted. Agree to the terms and conditions and the privacy policy and click Continue .

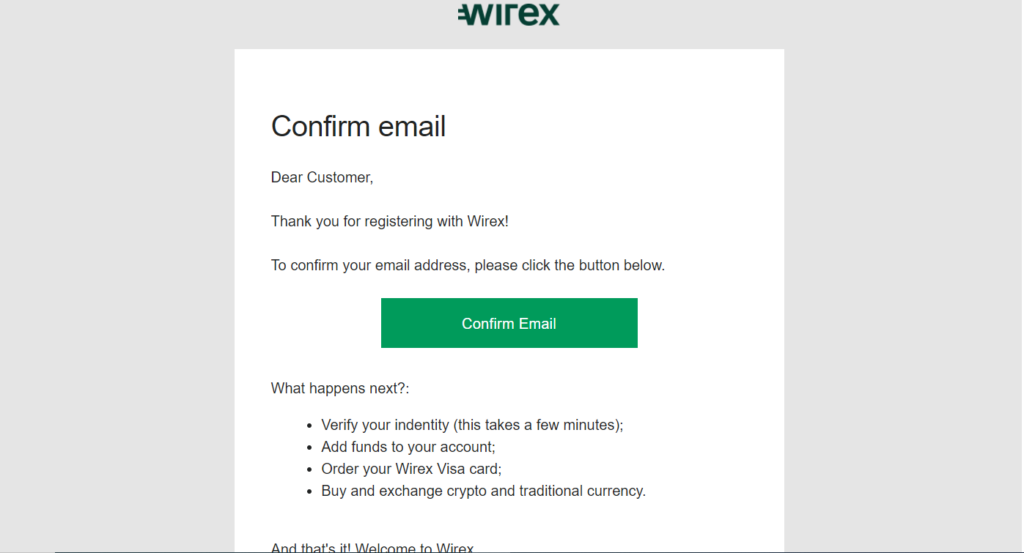

- Confirm your email address by going to your email and clicking Confirm Email .

- After confirming your email address, enter your home address details and click Continue .

- Double check your address and confirm it is correct by clicking My Address Is Correct .

- Enter information about yourself and according to your passport or identity card and click Next.

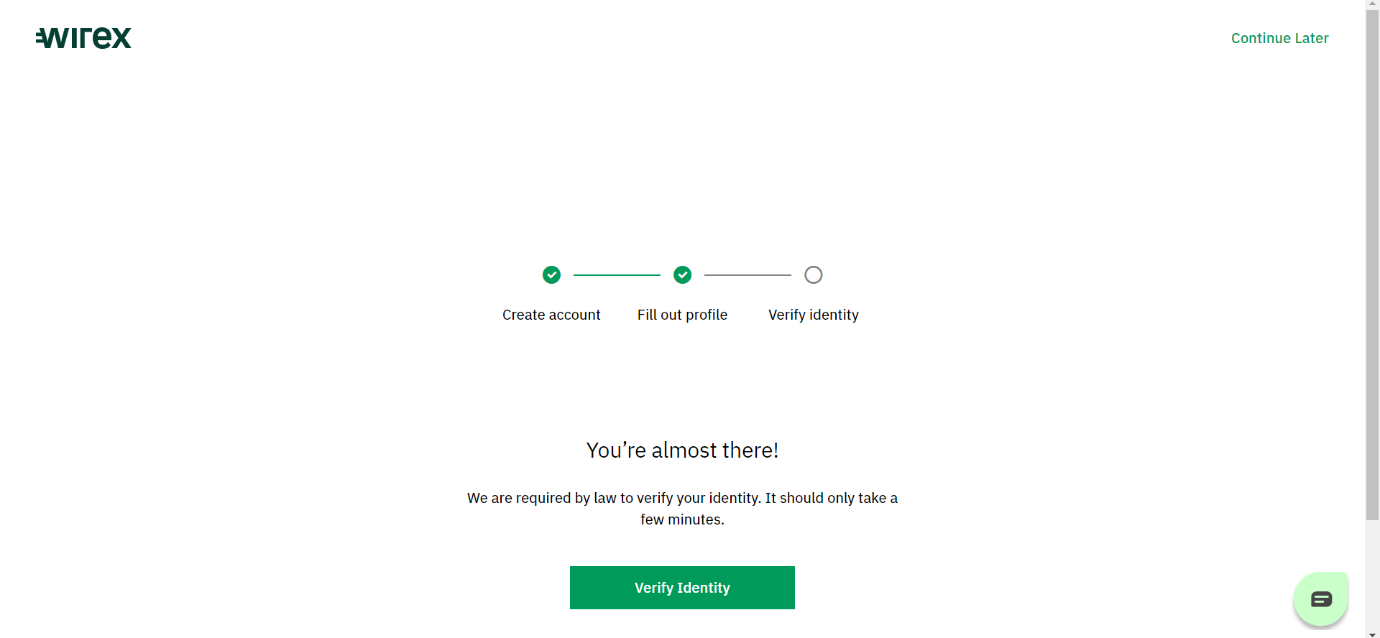

- Enter your phone number, making sure the area code is correct, then click Confirm and enter the confirmation code in the special field. At this point, Wirex needs to verify your identity. Click Verify Identity to continue.

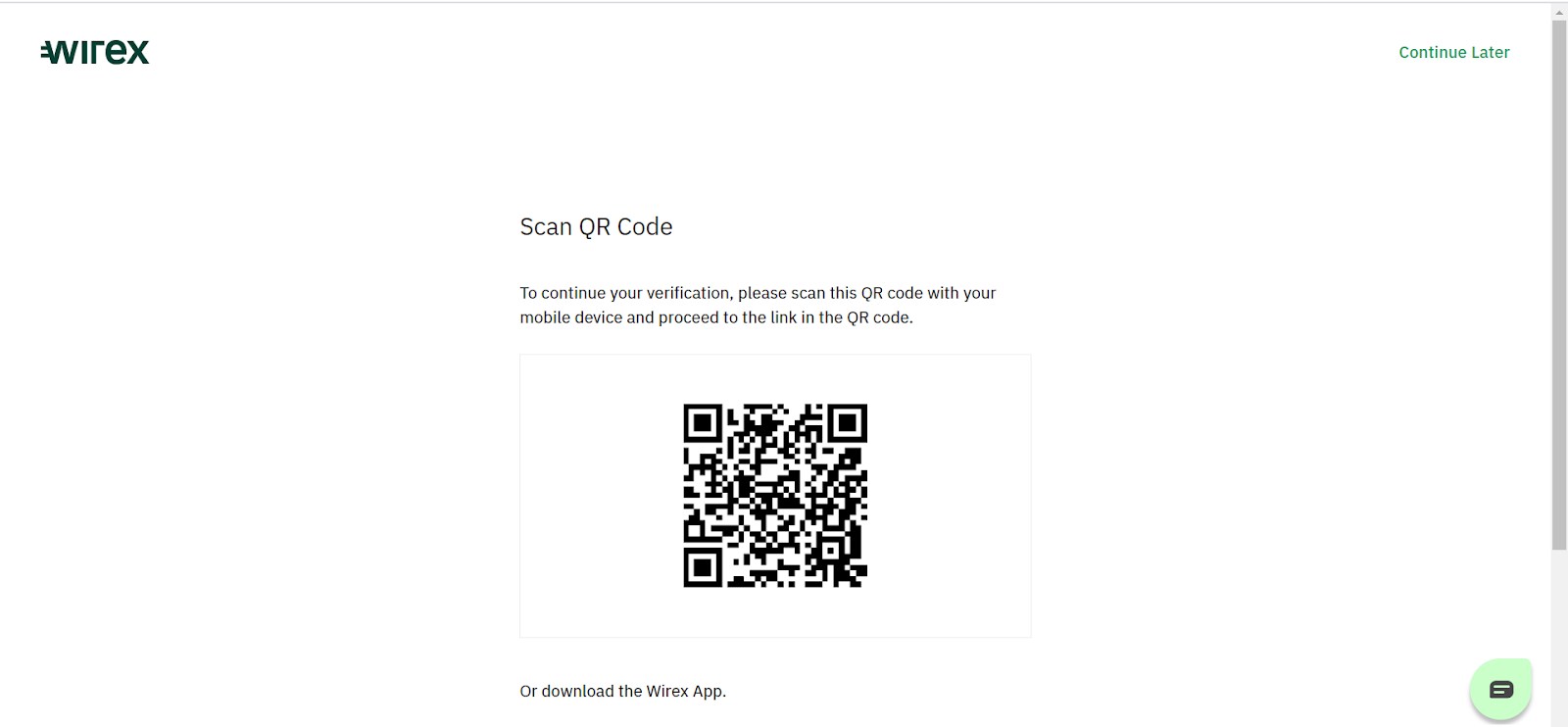

- Scan the QR code or download the Wirex app on your mobile phone.

- Follow the instructions on your mobile phone to confirm your address and details. Re-enter your ID or passport number, then take a photo of it as prompted.

- Then take a selfie and follow the instructions by writing down the given code and complete the process.

- You will receive a notification that the verification process will take a few minutes, but may take up to 24 hours.

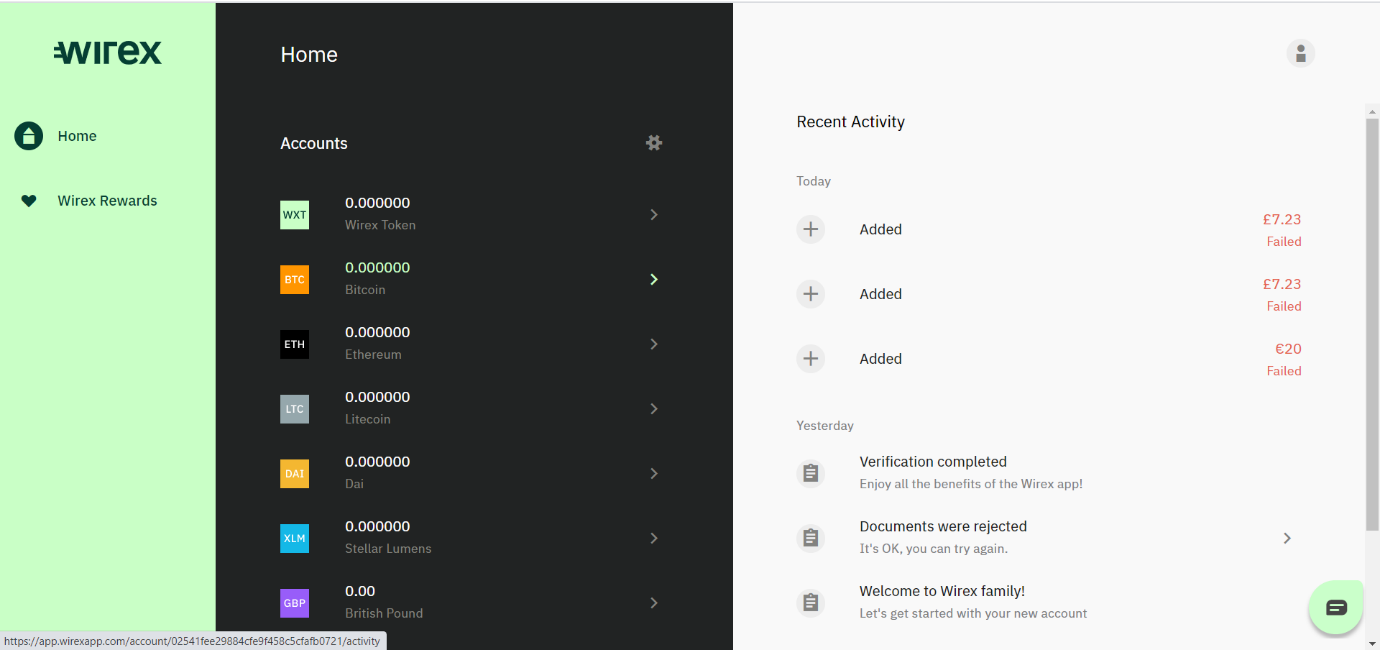

- After Wirex completes the verification, you will need to make a deposit to start using Wirex. The system automatically assigns a “WXT” account to verified users. Users who wish to deposit alternative cryptocurrencies or paper money will need to add the appropriate accounts.

How to use Wirex for cryptocurrency payments

Using the Wirex service for cryptocurrency payments is quite simple. Users can deposit and withdraw cryptocurrency using the Wirex control panel as shown below.

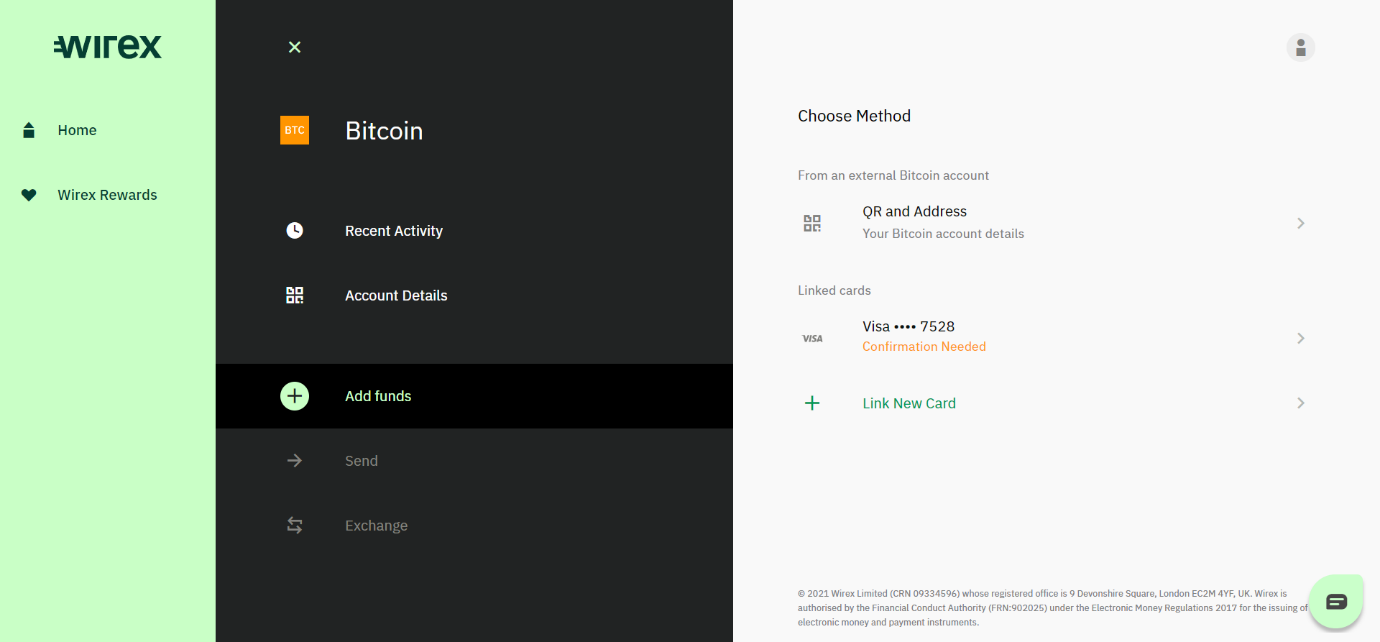

To make a cryptocurrency deposit, go to the control panel. In the Accounts section, select the cryptocurrency you want to deposit and click Add funds .

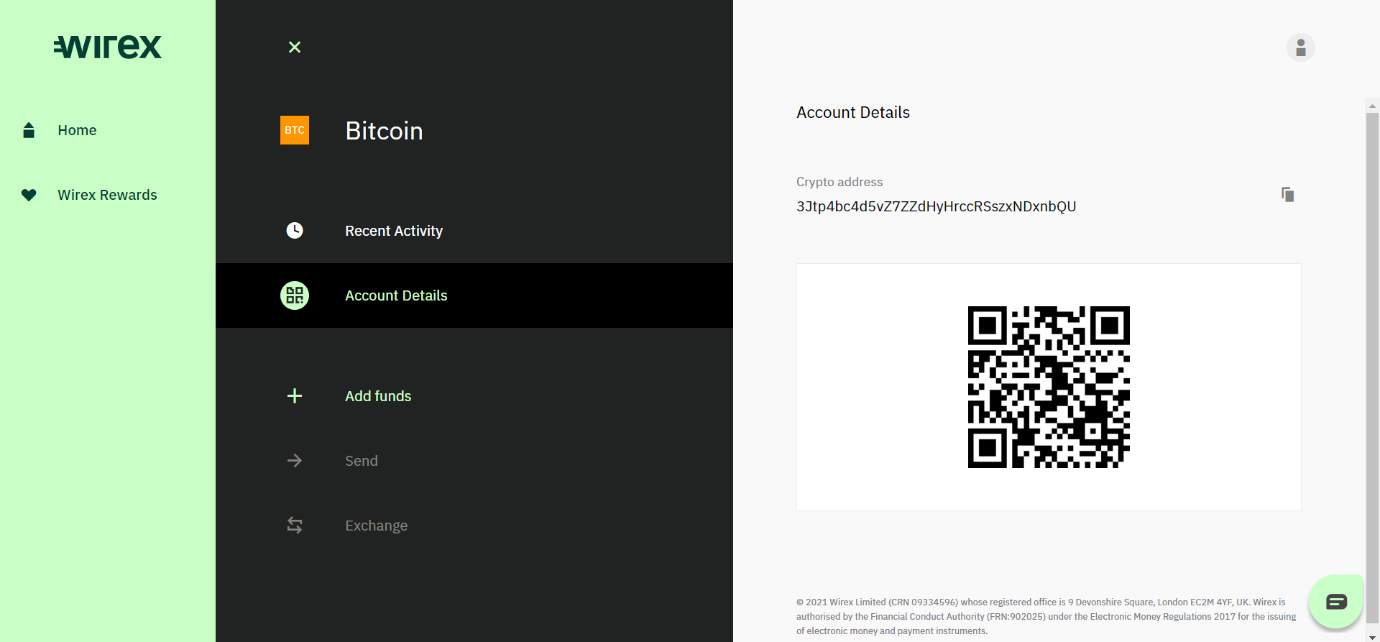

Now choose a payment method. Scan the QR code from your mobile wallet.

Enter the amount of assets in your wallet. If you want to deposit bitcoins after making a purchase with a card, just click on the linked card, enter the amount of the asset and click Confirm .

Users can withdraw cryptocurrency by transferring it from their Wirex account to external wallets. To withdraw your digital assets, go to your control panel, select the account you want to withdraw from, and click Send . Enter the amount you want to send, the destination wallet address and click Confirm .

Advantages and disadvantages of Wirex

The advantages of the platform include the following:

- universality . Wirex acts as a universal center for managing finances and payments in cryptocurrency and fiat;

- bonuses for using the card . The Wirex Debit Card allows users to spend digital and paper currency while receiving up to 2% cashback in cryptocurrency;

- low commissions ;

- referral program . Users can earn BTC from referrals and using Wirex card.

However, Wirex also has a number of disadvantages:

- in order to register an account with Wirex, all users must go through an identity verification process, which requires disclosure of personal information to the company;

- if the regulations in a certain geographic region change, the Wirex card may suddenly stop working because the company must comply with the laws of the country in which it operates.

Development prospects of Wirex

Wirex has significant growth prospects due to the growing interest in financial services in the field of digital assets. With the increasing adoption of cryptocurrencies globally, Wirex can take advantage of this trend by offering solutions for storing, buying and selling them. A debit card that allows users to spend crypto-assets with cashback is an example of such an innovation that is catching the attention of new users.

An additional opportunity for the development of Wirex is to expand the functionality and range of services. The introduction of new services, such as stablecoin loans without credit checks, can also attract more users and strengthen Wirex’s position in the market.

An important aspect of the future development of Wirex is the integration with decentralized finance (DeFi). The use of liquidity pools and credit pools to provide high interest rates on investments can make Wirex attractive to investors and users looking to monetize their crypto assets.

Conclusions

The Wirex platform continues to grow amid growing interest in cryptocurrencies and digital financial services. With solutions such as a debit card with cryptocurrency cashback and the ability to earn high interest rates on investments, the company has the potential for further growth.

Expanding the functionality of the platform and introducing new services will also contribute to strengthening its position in the market. The integration with DeFi allows Wirex to offer its users profitable conditions for earning on cryptoassets, which makes the platform attractive to both beginners and experienced investors.